Fixed Income Market Outlook 2025

BlogFixed Income Market Outlook 2025. Signs for the year what are the most important factors for fixed income markets this year? Here’s what we think is in store for 2025.

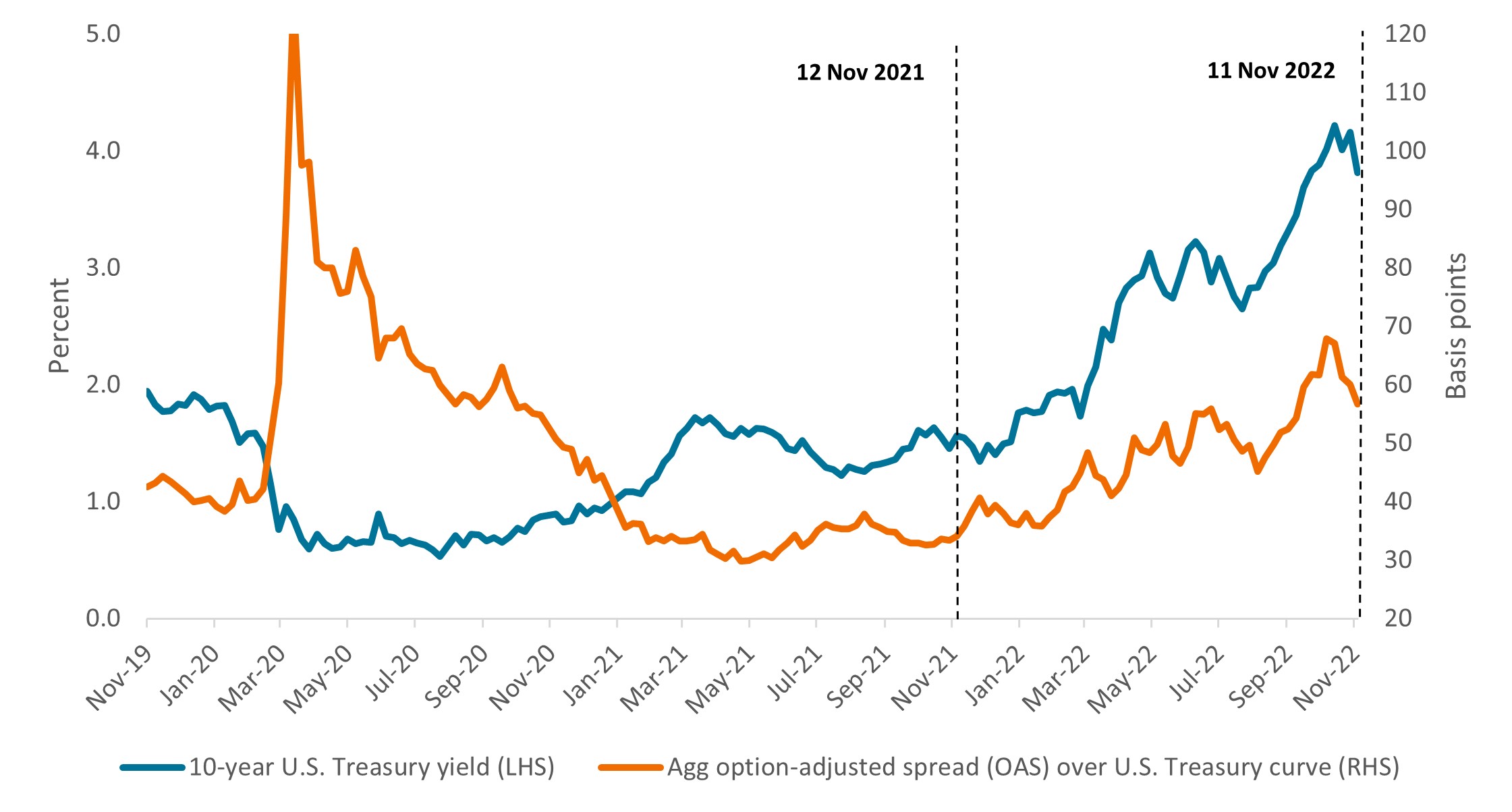

Our fixed income market outlook explores what’s ahead for bond investors in light of fed and market expectations for rate cuts. The outlook for government bonds.

Fixed Securities Definition + Examples, It expects to borrow more than $800 billion in the first quarter of 2025. After another volatile year, fixed income is presenting rare opportunities as we head into 2025.

policy tightening, the bond market and the business cycle, We believe 2025 will be a year for restoring balance—to policy decisions and to portfolios. The outlook for government bonds.

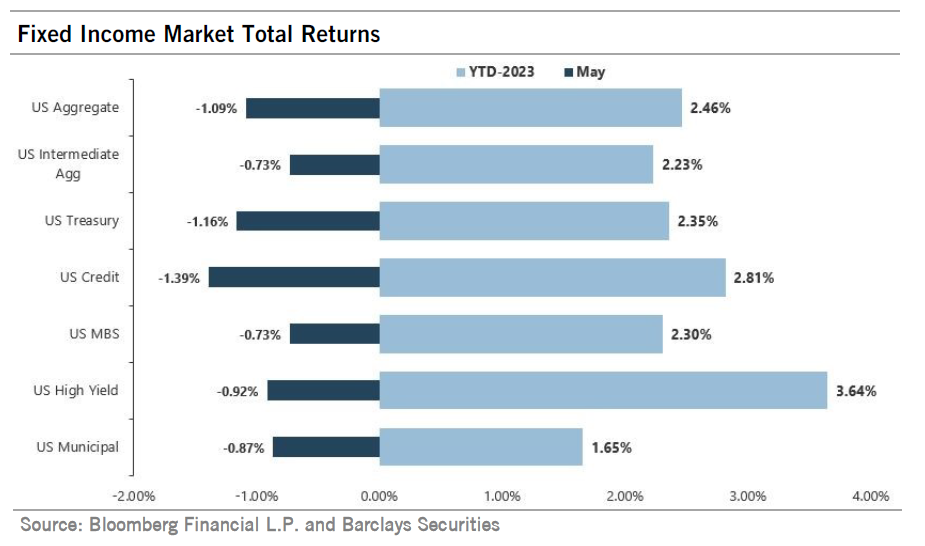

April 2025 Fixed Market Review Wilbanks Smith & Thomas, Inflation, now within striking distance of. Fixed income outlook 2025 bonds take center stage given current yield levels, slowing growth, and continued disinflation, fixed income moves into the limelight,.

Fixed Commentary June 2025 Maple Capital Management, Inflation, now within striking distance of. 2025 is expected to be a.

Fixed Q4 Market Outlook Value Partners, Fixed income outlook for 2025. Increased supply could test investor appetite and drive down bond prices.

Fixed Market Outlook September 2025 Nippon India Mutual Fund, It expects to borrow more than $800 billion in the first quarter of 2025. Increased supply could test investor appetite and drive down bond prices.

Global Fixed Quarterly Q4 2025 Outlook Nikko AM Insights, Fixed income outlook for 2025. Do you expect continued challenges for fixed income investors in 2025?

PGIM Fixed 1Q 2025 Outlook, Here we highlight our key convictions for how global developments will drive fixed income investing in 2025. It expects to borrow more than $800 billion in the first quarter of 2025.

US core fixed Better positioned going into 2025?, After another volatile year, fixed income is presenting rare opportunities as we head into 2025. Increased supply could test investor appetite and drive down bond prices.

Fixed 2025 Outlook A Manager Conversation with Ninepoint’s, The market consensus is generally that interest. History shows that when the federal reserve (fed) is paused and easing, longer duration higher quality fixed income has outperformed riskier assets, as.

Jason greenblath, senior portfolio manager at american century investments, joins to discuss fixed income investing.